As a bookkeeper, your role extends far beyond data entry. You’re the guardian of financial clarity—and one critical task separates the proactive from the reactive: reconciling the books with the client’s tax return. Let me share a story that underscores why this step isn’t just important—it’s non-negotiable.

THE $100K MISTAKE (AND HOW WE CAUGHT IT)

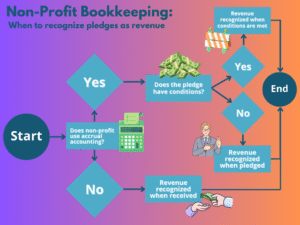

Before selling my bookkeeping firm, I had a client whose tax preparer filed a return using accrual-basis financials—despite the client operating on a cash basis. The tax return itself even stated “cash basis”! The result? Overstated income by $100K, leading to massive tax overpayments.

How it unfolded:

- My team reconciled the books to the tax return post-filing, as part of our standard workflow.

- We spotted discrepancies in revenue recognition and flagged them immediately.

- The client was able to amend their return and recover thousands in overpaid taxes.

This isn’t just a “win”—it’s proof that bookkeepers who tie books to tax returns transform from record-keepers to strategic partners.

WHY TAX RETURN RECONCILIATION IS NON-NEGOTIABLE

1. Tax Returns Are the Ultimate Source Document

If the books don’t align with the tax return, what’s the point? Tax returns are the final word on a client’s financial position for the IRS. Discrepancies here undermine your entire workflow and expose clients to risk.

Key questions to ask:

- Do revenue and expense totals match the tax return?

- Are balance sheet accounts (e.g., loans, equity) consistent?

- Is equity (retained earnings, owner distributions) aligned?

- Do fixed asset values and depreciation schedules match?

- Is the accounting basis (cash vs. accrual) aligned?

2. Tax Preparers Make Mistakes—Bookkeepers Catch Them

Tax preparers are human—and even the most experienced professionals or advanced software can misinterpret tax laws, overlook details, or make data-entry errors. Common issues include mismatched accounting bases, misapplied depreciation methods, or misreported equity transactions. These mistakes often stem from rushed deadlines, complex regulations, or incomplete client information. By reconciling the books to the tax return, bookkeepers act as a critical safety net, catching discrepancies before they escalate into costly IRS disputes or amended filings. If possible, get a copy of the tax return before it is filed so that mistakes can be corrected before the tax return is signed.

It always helps to build a collaborative relationship with tax preparers – you want them to see you as a partner, not an adversary.

TURNING RECONCILIATION INTO A CLIENT RETENTION TOOL

Clients hire bookkeepers to prevent disasters, not just clean up messes. By tying books to tax returns, you:

- Save them money (like the $100K recovery).

- Build trust through proactive error-spotting.

- Differentiate your services in a crowded market.

Final Takeaway

Reconciling books to tax returns isn’t just about accuracy—it’s about redefining your role as a strategic partner. When you catch errors before they cost clients thousands, you’re not just a bookkeeper. You’re a financial safeguard.

Ready to transform your firm’s impact? Great Bookkeepers Wanted helps bookkeepers implement workflows that prevent six-figure mistakes. Schedule a complementary discovery meeting to learn how!