“But it hasn’t hit the bank account yet!”

Picture this: A major donor just pledged $25,000 to your nonprofit’s capital campaign. If you’re using accrual accounting (and many nonprofits must), that pledge might need to be booked as income right now—even though your bank account hasn’t seen a penny. Welcome to the world of nonprofit accounting, where money can exist on paper long before it exists in reality.

The Pledge Paradox: Recording Income You Don’t Have

Imagine explaining to your Executive Director that you’ve recorded $100,000 in pledge income, but there’s only $10,000 in the bank. Sounds like a recipe for confusion, right?

Yet this accounting “magic trick” is actually required for many nonprofits. A major donor’s three-year pledge becomes income the moment they sign the commitment letter—not when they mail the checks.

“But that’s not how my personal finances work!” you might protest. And you’d be right. This is one of those areas where nonprofit accounting plays by different rules – if using accrual basis accounting.

When Must Your Nonprofit Use Accrual Accounting?

It is important to understand the regulations surrounding when a non-profit is required to use the accrual basis accounting method – the threshold is much less than that of a for-profit entity. Your nonprofit likely needs accrual accounting if:

- You’ve hit the big leagues: Annual revenue exceeds $1 million (IRS threshold)

- You’re swimming in federal waters: You receive federal grants, especially over $750,000 requiring Single Audits

- You answer to auditors: Your organization undergoes annual audits

- You follow GAAP: Your board, funders, or state requires GAAP compliance, which typically requires accrual accounting (though modified cash basis is permitted in limited circumstances)

Smaller grassroots organizations can often use cash basis, but as your nonprofit grows, accrual becomes almost inevitable.

The Pledge Recognition Rulebook

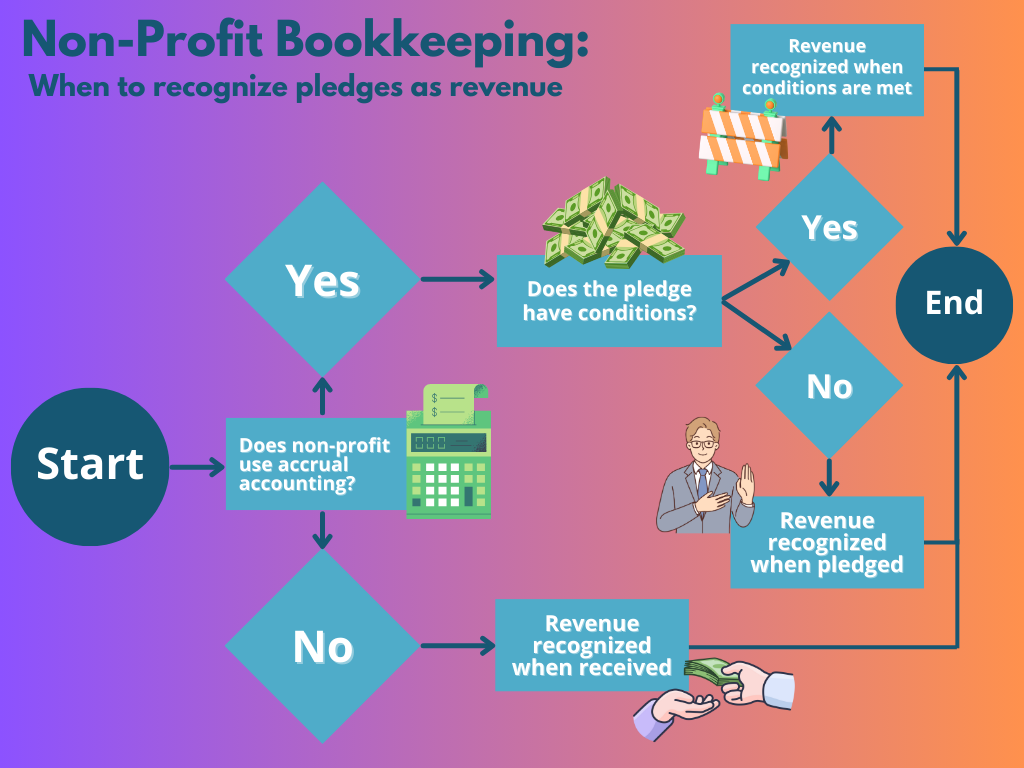

Let’s decode when pledges become income:

Unconditional Pledges: Book It Now

When a donor says “I pledge $50,000” without strings attached, that’s income immediately under accrual accounting. According to FASB ASC 958-605-25-8, the pledge must be recognized when received, provided there’s verifiable documentation.

Remember: “Legal enforceability” doesn’t mean you plan to sue donors—it simply means legal remedies would theoretically be available if needed (FASB ASC 958-605-25-9).

Conditional Pledges: Not So Fast

When a donor says “I’ll give $50,000 if you raise another $50,000 first,” you can’t recognize the income until the condition is met. FASB defines conditions as having both:

- A barrier that must be overcome

- A right of return/release from obligation

Think of conditions as roadblocks to recognition.

The Documentation Difference

A pledge scribbled on a cocktail napkin won’t cut it. FASB requires “sufficient evidence in the form of verifiable documentation” that a promise was made and received. Without it, it’s just a nice thought, not income.

Restrictions ≠ Conditions

Here’s where it gets tricky: A donor saying “Use this money only for the youth program” is creating a restriction, not a condition. Per FASB ASC 958-605-25-3, restrictions affect how you can use the money (and which net asset class it falls into—”with donor restrictions” or “without donor restrictions”), but not when you recognize it as income.

Multi-Year Pledges and Uncollectible Amounts

Multi-Year Pledges

For pledges expected to be collected beyond one year, FASB ASC 958-605-30-5 requires discounting to present value using an appropriate discount rate. This reflects the time value of money—a dollar promised three years from now isn’t worth a dollar today.

Allowance for Uncollectible Pledges

Even the most well-intentioned donors sometimes fail to fulfill pledges. FASB requires establishing an allowance for uncollectible pledges based on historical experience and specific donor circumstances. This ensures your financial statements don’t overstate expected future cash flows.

Real-World Pledge Scenarios

Scenario 1: The Straightforward Pledge

A board member pledges $10,000 at your annual gala, signing a pledge card with payment due in six months.

Accrual treatment: Record $10,000 as income immediately, with a pledge receivable.

Cash treatment: Record nothing until the check arrives.

Scenario 2: The Conditional Challenge

A foundation offers a $50,000 challenge grant if you can secure 100 new donors by year-end.

Accrual treatment: Record nothing until you’ve secured those 100 donors.

Cash treatment: Record nothing until the check arrives.

Scenario 3: The Restricted Gift

A donor pledges $25,000 specifically for your building renovation.

Accrual treatment: Record $25,000 as income immediately (classified as “with donor restrictions”).

Cash treatment: Record nothing until the check arrives.

Form 990 Considerations

Even if your organization uses cash basis internally, Form 990 requires reconciliation to accrual for certain items. This means you’ll need to track pledge information regardless of your internal accounting method.

Why This Matters Beyond Compliance

Getting pledge recognition right isn’t just about following rules—it affects:

- Financial transparency: Your financial statements should reflect promises made to your organization

- Strategic planning: Knowing future income helps with program planning

- Board confidence: Accurate financials build trust with your board

- Audit readiness: Proper pledge recording prevents audit headaches

The Bookkeeper’s Pledge Checklist

✓ Determine your accounting method: Cash or accrual?

✓ Document every pledge: Get it in writing

✓ Assess for conditions vs. restrictions: Understand the difference

✓ Apply present value discount: For multi-year pledges

✓ Establish uncollectible allowance: Based on historical experience

✓ Create separate cash projections: Know when the money will actually arrive

Remember: Even when you record pledges as income, you still need to track when the cash will actually arrive for budgeting purposes.

The Bottom Line: Understanding when to recognize pledges as income is a critical skill for nonprofit bookkeepers. Get it right, and you’ll provide your organization with accurate financial information that balances optimism with reality.

Want to learn more about how nonprofits should handle pledges and revenue? Check out my YouTube video for a clear, easy-to-understand explanation! Watch it here

#NonprofitAccounting #PhantomRevenue #PledgeRecognition #BookkeepingTips #NonprofitFinance #NonprofitBookkeeping #BookkeepingTips #RevenueRecognition #NonprofitAccounting #FASB #GAAP #PledgeRecognition #AccrualAccounting #NonprofitFinance #BookkeepingBasics #Accounting101 #NonprofitCompliance #FinancialReporting #BookkeepingBestPractices #NonprofitManagement #AccountingTips #BookkeepingForNonprofits #FinancialAccounting #BookkeepingServices #NonprofitResources #AccountingStandards #FinancialLiteracy #NonprofitConsulting #BookkeepingEducation #GreatBookkeepersWanted #AccountingProfessionals #NonprofitLeadership #BookkeepingSkills #FinancialManagement