WELCOME TO OUR RESOURCE HUB

Your go-to hub for expert insights, practical tools, and strategic advice tailored for bookkeepers and business owners. Whether you’re looking to streamline operations, expand your client base, or navigate the sale or purchase of a bookkeeping firm, our curated content is here to support your journey.

CPA vs. EA: How Bookkeepers Can Guide Clients to the Right Tax Professional

CPA vs. EA: How Bookkeepers Can Guide Clients to the Right Tax Professional As a bookkeeper, you’re often the first line of defense when your small business clients have questions about taxes. One of the most common dilemmas they face is whether to hire a Certified Public Accountant (CPA) or

Demystifying Accounting: A Colorful Approach to Debits, Credits, and Balance

Accounting can feel like a maze of confusing rules and counterintuitive logic—especially when you’re first learning the ropes. If you’ve ever wondered why a bank account increases with a debit, or why debits and credits always have to match, you’re not alone! In our latest YouTube video, Lindsay Kline, founder

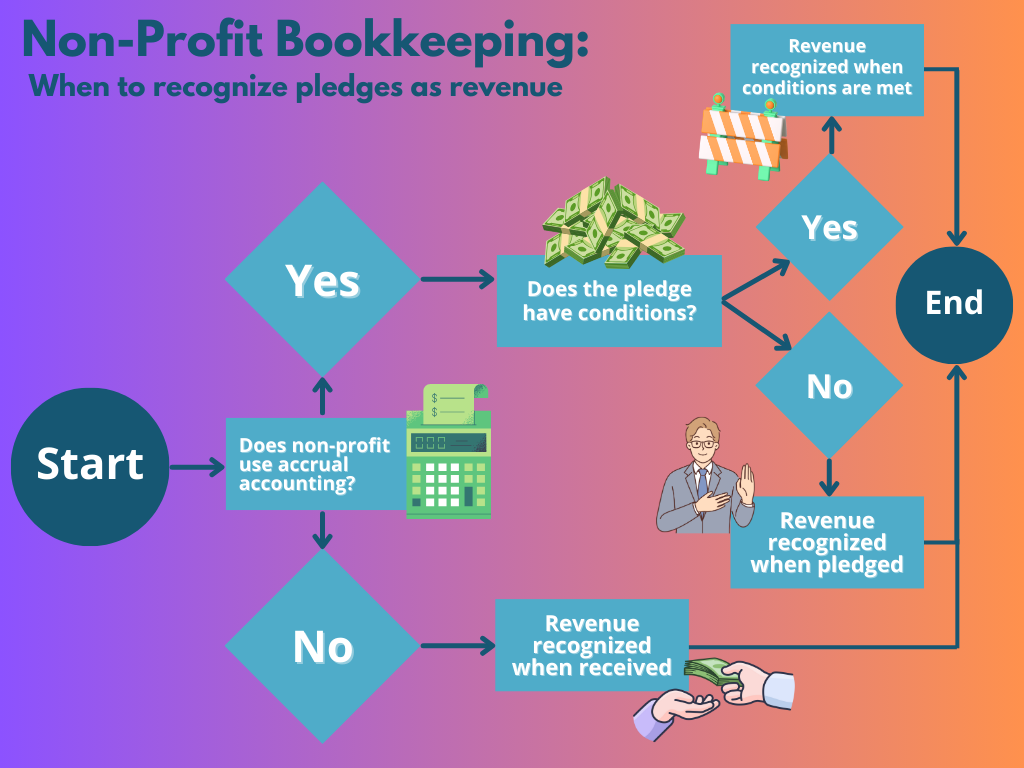

When Non-Profits Must Recognize Pledges as Revenue

“But it hasn’t hit the bank account yet!” Picture this: A major donor just pledged $25,000 to your nonprofit’s capital campaign. If you’re using accrual accounting (and many nonprofits must), that pledge might need to be booked as income right now—even though your bank account hasn’t seen a penny. Welcome to

Embracing Your Identity: The Key to Success in Bookkeeping

Recently, I found myself captivated by an older season of The Amazing Race. What struck me was that there was a team consistently winning first place that wasn’t nearly the physically strongest. I watched closely, trying to determine their “secret sauce” for success. I realized that they demonstrated remarkable mental strength.

Why Bookkeepers Must Tie Tax Returns to the Books: A $100K Lesson in Accuracy

As a bookkeeper, your role extends far beyond data entry. You’re the guardian of financial clarity—and one critical task separates the proactive from the reactive: reconciling the books with the client’s tax return. Let me share a story that underscores why this step isn’t just important—it’s non-negotiable. THE $100K MISTAKE

Bookkeepers: Spotting Risk in Shareholder Loans Is a Key Advisory Opportunity

As a bookkeeper, you’re not just entering transactions—you’re in a unique position to recognize financial patterns that may carry serious consequences for your clients. One example that shows up frequently on S corporation balance sheets is the shareholder loan. Many business owners don’t understand what it is or how it